About the Asset Allocation Tool#

Visit the Asset Allocation Tool

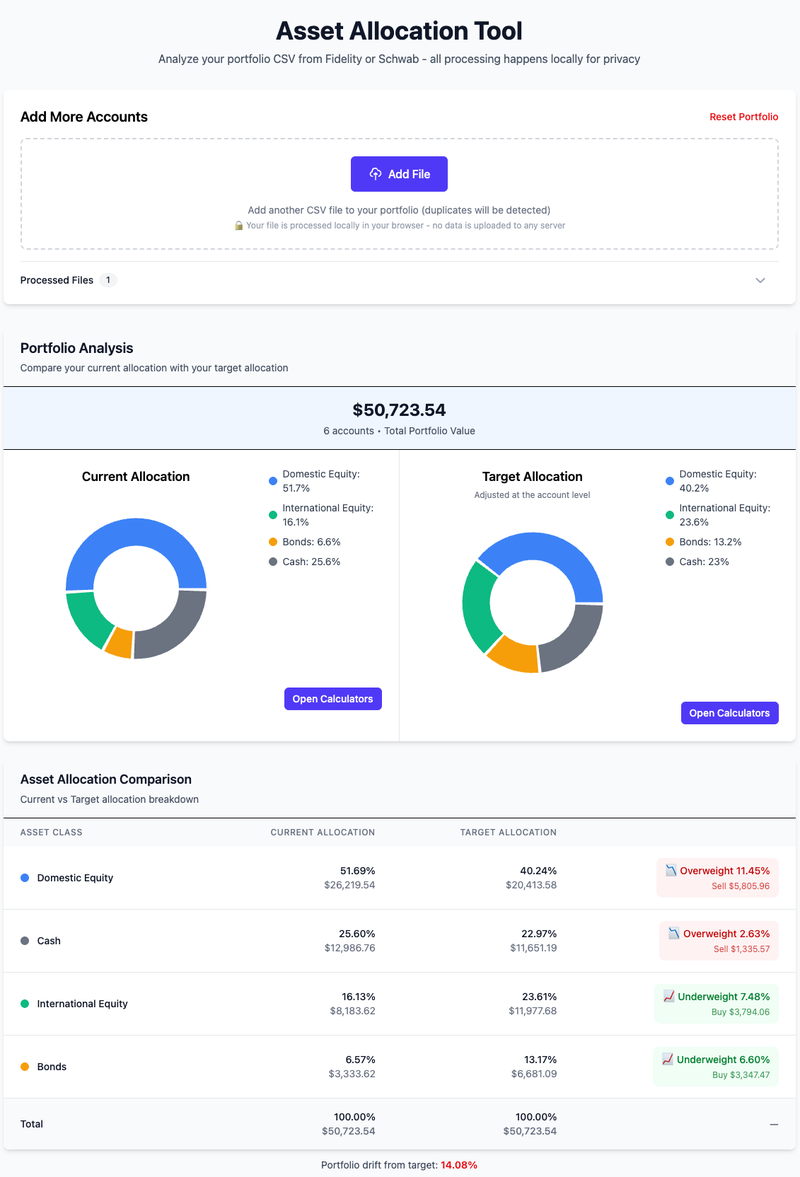

Managing investments across multiple financial institutions like Charles Schwab and Fidelity is something I’ve tracked in Google Sheets for years, but still involved a reasonable amount of manual work. I built this tool to create an easier, more streamlined way to:

- Upload CSV files from various institutions

- Get a comprehensive view of asset allocations across all accounts

- Set account-level asset allocation targets

- Add manual assets not tracked by institutions

- Receive recommended trades to rebalance portfolios

- Run some simple “back of napkin” calculations

Privacy-First Design#

A core principle of this tool is that all processing of CSVs happens locally. When you process a CSV file, nothing is ever transmitted to external servers. Your financial data stays on your device, ensuring privacy and security. This was a non-negotiable requirement for me when building a tool that handles sensitive financial information.

Key Features#

Portfolio Management#

- Multi-Institution Support: Import CSVs from Charles Schwab of Fidelity

- Asset Classification: Categorization of holdings into asset classes, including multi-class funds

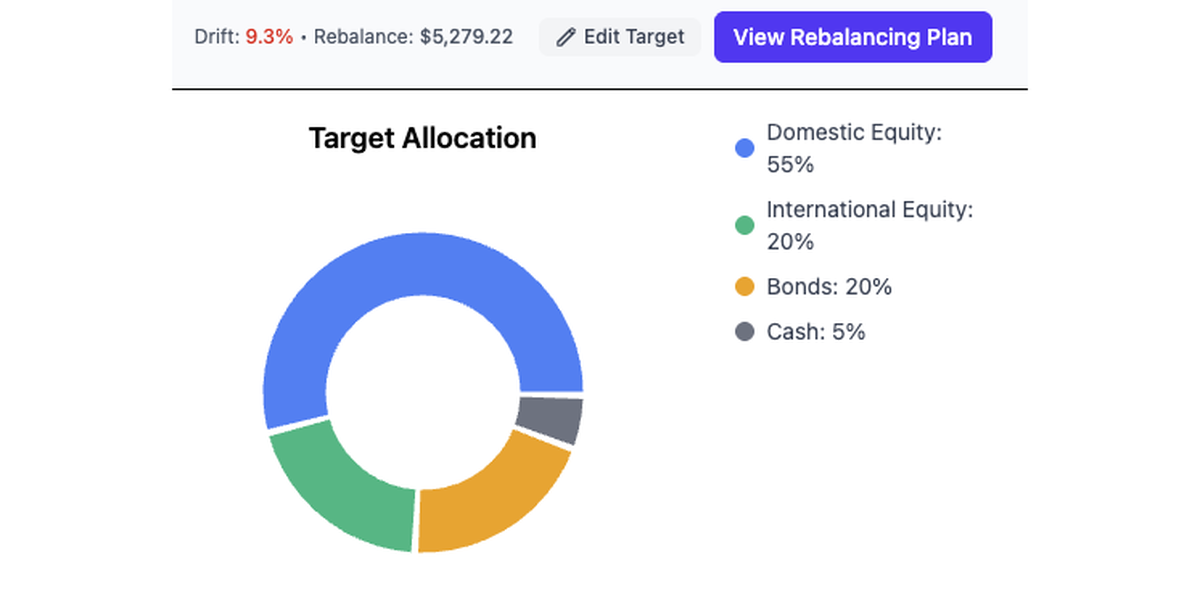

- Target Allocation: Set and track target allocations at the account level

- Rebalancing Recommendations: Get specific trade suggestions to align with your targets

- Manual Asset Tracking: Add assets held outside traditional brokerages

Financial Calculators#

The tool includes several “back of the napkin” calculators for quick financial snapshots:

- 4% Rule Calculator: Estimate retirement income based on portfolio size

- Growth Projections: Model portfolio growth based on simple assumptions about asset class returns

Asset Classification System#

One of the most convenient features is the asset classification system. Using Cloudflare KV store, I maintain a simple database that breaks down assets or funds into their component asset classes. For example:

- AAPL → 100% Domestic Equity

- FFNOX → 51.57% Domestic Equity, 33.82% International Equity, 14.58% Bonds, 0.03% Cash

- BTC → 100% Crypto

This granular classification enables accurate portfolio analysis even when holding multi-asset or target retirement mutual funds and ETFs.

Technical Implementation#

Frontend Stack#

- Vite

- React

- TypeScript

- Tailwind CSS

- Cursor

Backend Infrastructure#

- Cloudflare Workers: Serverless hosting

- Cloudflare KV: Distributed key-value store for asset classifications

- Cloudflare Zero Trust: Secure access control for the KV admin interface

Learning Experience#

This project served as an excellent opportunity to explore Cloudflare’s ecosystem, particularly:

- Implementing a KV store for persistent data storage

- Building serverless applications with Workers

- Securing administrative interfaces with Zero Trust

The combination of local-only processing for sensitive data with cloud-based asset classification lookups creates a perfect balance between privacy and functionality.

Future Enhancements#

Potential areas for expansion include:

- Support for additional financial institutions

- More sophisticated rebalancing algorithms

- Efficient frontier modeling

- Historical performance tracking